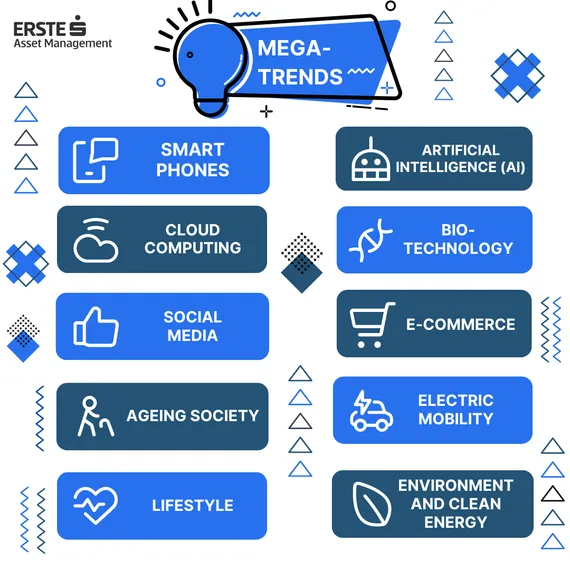

Megatrends will shape the world for decades to come. We are at the beginning of far-reaching developments in people's lifestyles, the use of new technologies (e.g. artificial intelligence), groundbreaking advances in healthcare or in the environment (e.g. clean energy). Megatrends generate growth and therefore opportunities for investors who invest in the most exciting companies. With the ERSTE FUTURE INVEST fund, you invest in shares in what we consider to be the 5 most important megatrends. Please note that investing in securities entails risks in addition to the opportunities described.

Future-oriented investment in megatrends

Buy funds individually

If you have an online account with Erste Bank und Sparkasse, you can buy ERSTE FUTURE INVEST directly by clicking on "Buy fund". You can then decide for yourself how much you want to invest in each fund.

Save funds regularly

With the s Fonds Plan, we support you with your investments.

The s Fonds Plan combines the gradual accumulation of assets with the earnings potential of securities.

And from 30 euros per month with a fund of your choice.

All information about the fund

ERSTE FUTURE INVEST is an actively managed global equity fund that invests in megatrends. In addition to the predominant focus on individual stocks, specialized equity funds are added to the portfolio.

*If you click "Buy fund" or "Open s Fund Plan", you will be redirected to George, Austria's most modern banking service.

Note: Depending on the performance of the investment fund, the performance of an s Fund Plan will differ from (that of) a single investment (higher or lower). A loss of capital is possible in both cases

Technology & innovation

Behind these buzzwords lies a whole range of trends such as "robotics", "Internet of Things", "artificial intelligence", "virtual and augmented reality" and "autonomous driving".

From the robot revolution in industry to seamless networking in the Internet of Things and the ground-breaking application of artificial intelligence (AI), the impact extends across all sectors and creates unimagined opportunities for efficiency gains, new business models and solutions to global challenges. In a world increasingly shaped by technology, the ability to adapt and continuously innovate is becoming a key to business success.

Lifestyle

Lifestyle is changing not only in terms of nutrition, but also in other areas such as fitness and body awareness. It is also becoming normal to share cars, workplaces, homes and much more ("sharing economy").

Digitalization has revolutionized our communication. Smartphones and social media are omnipresent and have fundamentally changed the way we interact with each other. The availability of fast internet and the spread of video calls have bridged physical distance and enable us to communicate with people all over the world in real time.

Digitalization is also changing the way we consume. E-commerce platforms offer a convenient way to buy goods and services without leaving home. Personalized recommendation algorithms use AI to understand our preferences and present tailored offers.

Automation and robotics have already reshaped many jobs, and the skills required in the modern economy are constantly evolving. People must adapt to lifelong learning in order to be successful in a changing world of work.

Leisure time is also changing as a result of extensive digitalization: Streaming services offer unlimited access to content tailored to our preferences. Virtual reality and augmented reality are opening up new possibilities for immersive entertainment.

Overall, the megatrends of digitalization and AI are leading to a profound change in our lifestyles, from the way we work and communicate to our consumption habits and leisure activities. These developments offer both opportunities and challenges and require us to continuously adapt our skills and habits in order to succeed in this digital era.

Health & preventive health care

Globally, society is becoming increasingly older. Companies that offer products related to medical care and support can benefit from this development.

Although the population is getting older, illnesses are still a part of ageing and therefore this change brings with it numerous challenges as well as opportunities. On the one hand, the digitalization of the medical sector around the topic of big data and AI, which should provide significant support in diagnosis, early detection and treatment, as well as the topic of digital patient care, is a key issue.

The recent Covid-19 pandemic also shows how challenged the healthcare sector is during global crises and what growth opportunities it has in the long term.

This megatrend shows how important the medical sector is and how important it could become. Companies that offer products and services related to medical care and support can benefit from this. This includes, for example, operators of hospitals and care homes. Other beneficiaries include pharmaceutical, generics and biotechnology companies that are active in the research, production and distribution of medicines, as well as companies that deal with the topics of healthy nutrition and preventive healthcare.

Environment & clean energy

The massive expansion of renewable energy is necessary to achieve the targets set out in the Paris Climate Agreement ("climate challenge"). Other sub-trends are "smart cities", "water efficiency" and trends towards waste prevention.

The megatrend of the environment and clean energy has gained enormous importance in recent years. In the wake of climate change and the resulting consequences for our environment, such as global warming, awareness has increased.

In this context, renewable energy sources such as solar energy, wind energy and hydropower are becoming increasingly important. In the long term, they offer a sustainable and environmentally friendly energy supply.

Economic forces in transition

On average, the economies of Western countries are growing less rapidly than those of emerging markets. This development is being driven by the rapid growth in consumption and investment in the emerging markets.

The consequences of this trend are far-reaching. Companies in these emerging countries are becoming increasingly competitive and are even able to offer products and services that meet Western standards in many areas. The traditional industrialized nations are therefore under strong competitive pressure and must constantly adapt in order to survive global competition.

At the same time, however, the transformation of these economic forces also offers enormous opportunities for Western industrialized nations. Synergies can be created and joint business models developed through the exchange of knowledge and experience.

Overall, it remains to be seen how this megatrend will develop in the future. What is clear, however, is that companies will need to be increasingly networked with each other on a global level in order to benefit from the opportunities presented by this change.

Interested in learning more about megatrends?

Disclaimer and legal notes

Disclaimer

This document is an advertisement. Please refer to the prospectus of the UCITS or to the Information for Investors pursuant to Art 21 AIFMG of the alternative investment fund and the Key Information Document before making any final investment decisions. All data is sourced from Erste Asset Management GmbH, unless indicated otherwise. Our languages of communication are German and English.

The prospectus for UCITS (including any amendments) is published in accordance with the provisions of the InvFG 2011 in the currently amended version. Information for Investors pursuant to Art 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in connection with the InvFG 2011.

The fund prospectus, Information for Investors pursuant to Art 21 AIFMG, and the Key Information Document can be viewed in their latest versions at the web site www.erste-am.com within the section mandatory publications or obtained in their latest versions free of charge from the domicile of the management company and the domicile of the custodian bank. The exact date of the most recent publication of the fund prospectus, the languages in which the Key Information Document is available, and any additional locations where the documents can be obtained can be viewed on the web site www.erste-am.com. A summary of investor rights is available in German and English on the website www.erste-am.com/investor-rights as well as at the domicile of the management company.

The management company can decide to revoke the arrangements it has made for the distribution of unit certificates abroad, taking into account the regulatory requirements.

Detailed information on the risks potentially associated with the investment can be found in the fund prospectus or Information for investors pursuant to Art 21 AIFMG of the respective fund. If the fund currency is a currency other than the investor's home currency, changes in the corresponding exchange rate may have a positive or negative impact on the value of his investment and the amount of the costs incurred in the fund - converted into his home currency.

Our analyses and conclusions are general in nature and do not take into account the individual needs of our investors in terms of earnings, taxation, and risk appetite. Past performance is not a reliable indicator of the future performance of a fund.

The issue and redemption of unit certificates and the execution of payments to unit holders has been transferred to the Fund's custodian bank/depositary, Erste Group Bank AG, Am Belvedere 1, 1100 Vienna, Austria. Redemption requests can be submitted by investors to their custodian bank, which will forward them to the Custodian Bank/Depositary of the Fund for execution via the usual banking channels. All payments to investors are also processed via the usual banking clearing channel with the investor's custodian bank. In Germany, the issue and return prices of shares are published in electronic form on the web site www.erste-am.com (and also at www.fundinfo.com). Any other information for Shareholders is published in the Bundesanzeiger, Cologne.